China Steel Corp (中鋼) yesterday held steady domestic steel prices for delivery next month, snapping four straight months of upticks as customers digest the effects of price hikes and macroeconomic factors.

The steelmaker said its move matched steps made by Chinese peers Baowu Steel Group Ltd (寶武鋼鐵), the world’s biggest steelmaker, and Angang Steel Co (鞍山鋼鐵), which both paused price hikes for hot-rolled and cold-rolled steel for domestic delivery next month. 22 Gauge Galvanized Sheet Metal

“China Steel has been hiking prices following the global steel market’s uptrends since the beginning of this year, but it will take more time for the supply chains to pass the higher costs to downstream clients,” China Steel said in a statement.

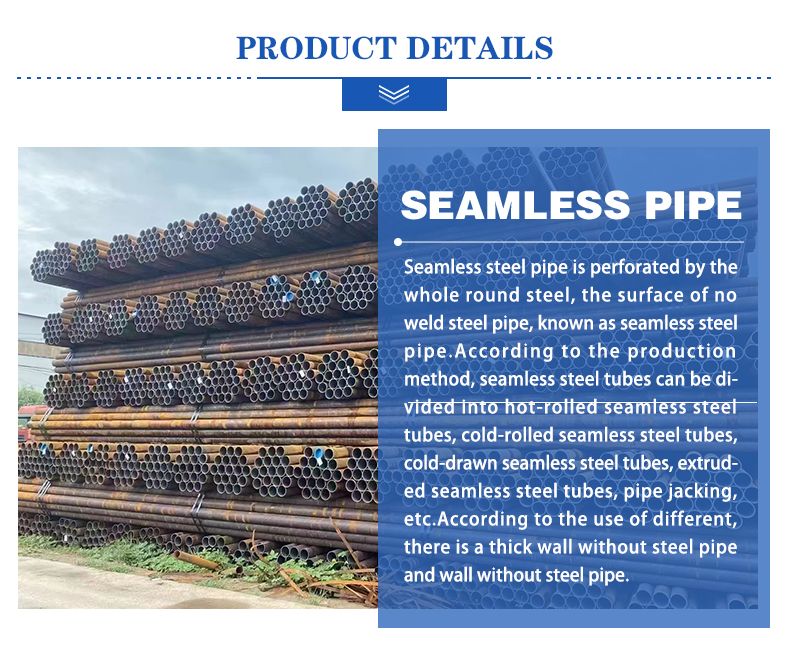

Photo courtesy of China Steel Corp

Customers have reduced inventory to healthy levels, but they became conservative about building inventory to cope with the steel industry’s peak season this quarter, as banking turmoil in the US and Europe as well as escalating geopolitical tensions weakened their confidence, the Kaohsiung-based company said.

“Steel prices would enter a transition period in the short term,” it said.

The company said that steel prices would probably start trending upward again after the short pause, given that most Asian steel markets are entering a benign consolidation phase before any breakouts.

Steel prices in the US and Europe are rebounding thanks to improved consumer confidence, it said.

In addition, a pull back in raw material costs is also keeping global steel prices from climbing, the statement said.

Iron ore prices have fallen to between US$120 and US$130 per tonne, while coking coal prices fell to between US$285 and US$300 per tonne, it said.

However, China Steel has a positive view, expecting that demand would bounce back later this year due to improving demand for housing projects and home appliances as the government rolls out tax incentives to upgrade to green products.

To align with the muted market sentiment in Taiwan and the rest of Asia, China Steel said it did not adjust its domestic prices, although manufacturing costs are on the rise.

The company expects its electricity bill to surge by NT$1.2 billion (US$39.39 million) annually after Taiwan Power Co (台電) increased electricity rates by 17 percent for industrial heavy users starting this month.

Higher global crude oil prices and rising water prices also pushed up manufacturing costs, China Steel said.

Prices for its hot-rolled and cold-rolled steel plates, electro-galvanized steel coil used in building construction, as well as galvannealed steel coil used in home appliances and computers would remain at last month’s levels, it said.

BOOST: Demand for AI-related products increased suddenly in Q4 of last year, a company official said, adding that TSMC is considering building another fab in Kumamoto, Japan Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said that its revenue would grow up to 25 percent this year, expected to be driven by strong demand for advanced chips for high-performance computing and artificial intelligence (AI) applications. The world’s largest contract chipmaker saw revenue contract 4.5 percent to NT$2.16 trillion (US$68.42 billion) last year, as customers grappled with an inventory correction cycle. With inventory digestion efforts approaching an end, TSMC said its business has bottomed out. “For the full year of 2024, we expect [revenue] to increase by a low-to-mid 20 percent in US dollar terms,” TSMC chief executive officer C.C. Wei

IN THE MARKET: Although the chipmaker applied for 100 hectares in the Southern Taiwan Science Park, it did not specifiy that Chiayi was the location in question Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday it was still considering venue options for its new advanced wafer fab, contrary to a local media report earlier in the day that the chipmaker was planning to build a 1-nanometer wafer plant in Chiayi County. While the world’s largest contract chipmaker did not directly comment on the matter of Chiayi as a potential location, TSMC said in a statement that the company would need to consider all factors before making a final decision on where to build the 1-nanometer fab. The Chinese-language Economic Daily News cited unnamed sources as saying that TSMC had

MORE CHIPS: The OpenAI executive revived his US fab funding drive by approaching several investors, although some US lawmakers are scrutinizing one firm’s backing OpenAI CEO Sam Altman, who has been working to raise billions of dollars from global investors for a chip venture, aims to use the funds to set up a network of factories to manufacture semiconductors, several sources with knowledge of the plans said. Altman has had conversations with several large potential investors in the hopes of raising the vast sums needed for chip fabs, they said. Firms that have held discussions with Altman include Abu Dhabi-based G42, sources told Bloomberg last month, with another named firm being Softbank Group Corp, some of them added. The project would involve working with top chip manufacturers,

Steel Plate AI FEATURES: The S24 Ultra smartphone is said to be able to interpret foreign language phone calls and translate texts in real time, and provide better navigation Samsung Electronics Co on Wednesday announced its latest Galaxy smartphones with new artificial intelligence (AI) features as the South Korean giant seeks to win back its spot as the world’s biggest phone seller from Apple Inc. “Artificial Intelligence will bring about great change in the mobile industry,” Samsung president T.M. Roh said as he launched an event in a sports center in the Silicon Valley city of San Jose, California. Mobile devices are to become the primary access points for AI, with Samsung aiming to be a leader on that path, Roh added. The premium S24 Ultra smartphone unveiled at the event is